tax abatement definition for dummies

Post the Definition of tax abatement to Facebook Share the Definition of tax abatement on Twitter. A reduction in the amount of tax that a business would normally have to pay in a particular.

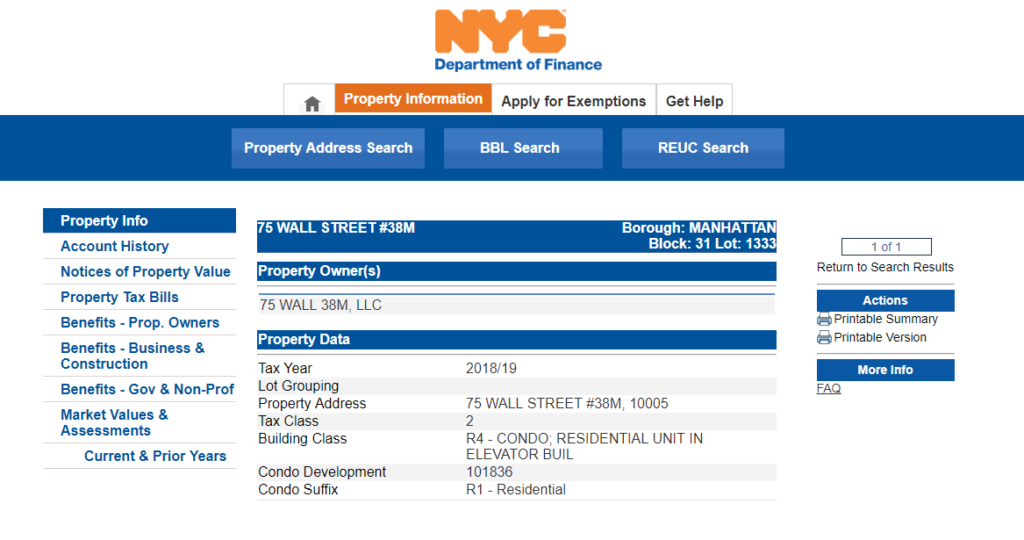

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

How Does an Abatement Work.

. State the type of penalty you want removed. Tax abatement on property is a major savings. Abatement of tax refers to a reduction in or reprieve from a tax debt or any other payment obligation.

This annual expense does not disappear when the mortgage is completely paid. It represents part of the ongoing cost of owning a home. Johns house is very old and he is able to have it added to the.

An amount by which a tax is reduced See the full definition. Abatement in legal business or financial situations refers to the lessening reduction or ending of something. Recently the GASB published GASB Statement No.

Sometimes the IRS will agree to remove some of the penalties that were assessed. Tax Abatements 101. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the percentage being charged like an interest rate or a tax bracket reduction.

A sales tax holiday is another instance of tax abatement. Tax increment financing TIF is a financial tool used by local governments to fund economic development. An abatement is a reduction in a tax rate or tax liability.

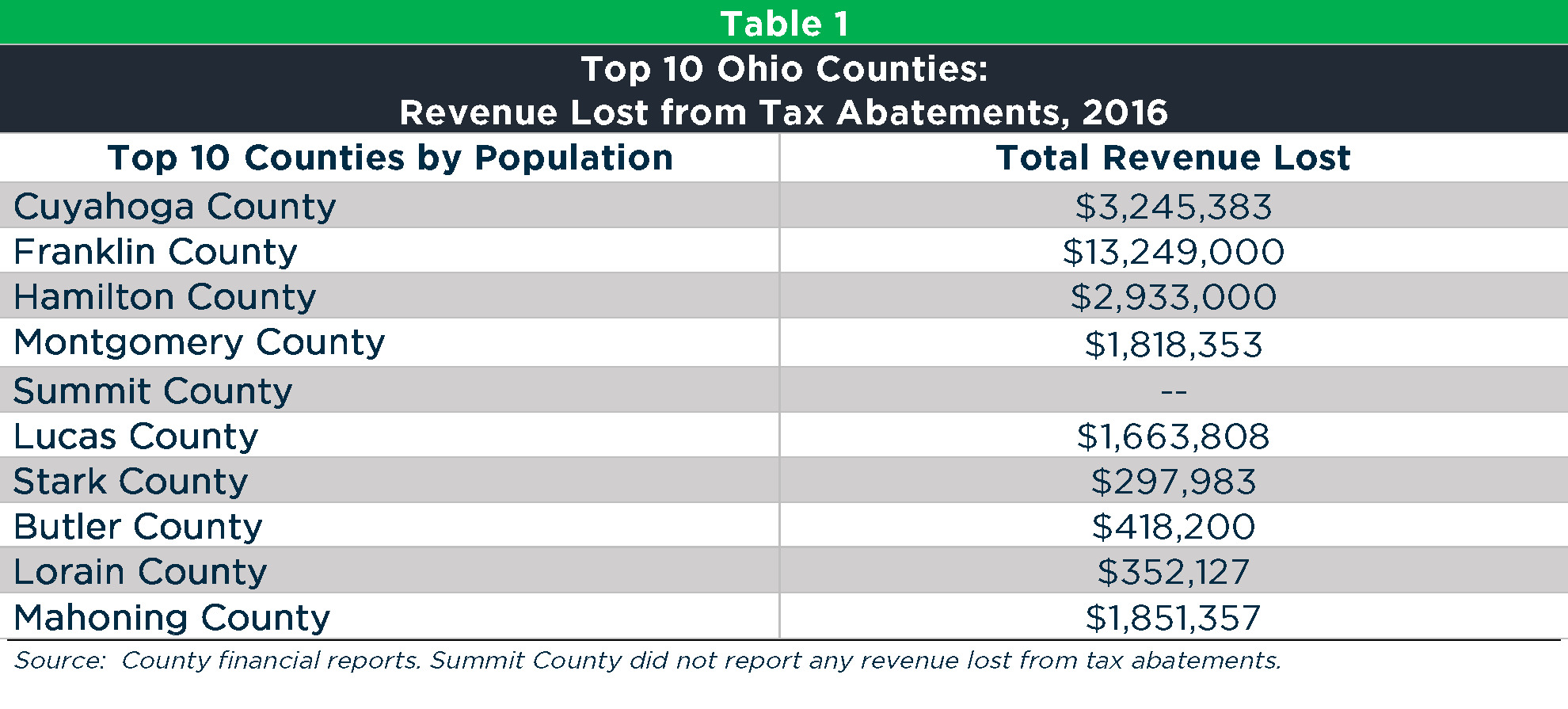

Moreover it is something unpleasant or undesirable. 77 Tax Abatement Disclosures that will require those state and local governmental entities that offer tax abatements to provide details about the program or programs in the note disclosures. A taxpayer seeking abatement of taxes assessed on property has the burden of proving the disproportionate payment of taxes by a preponderance of the evidence.

An exemption reduces the taxable value of a property which in turn lowers the taxes owed. Dictionary Entries Near tax abatement. That said the same owner may qualify for a tax exemption on one property and not on another.

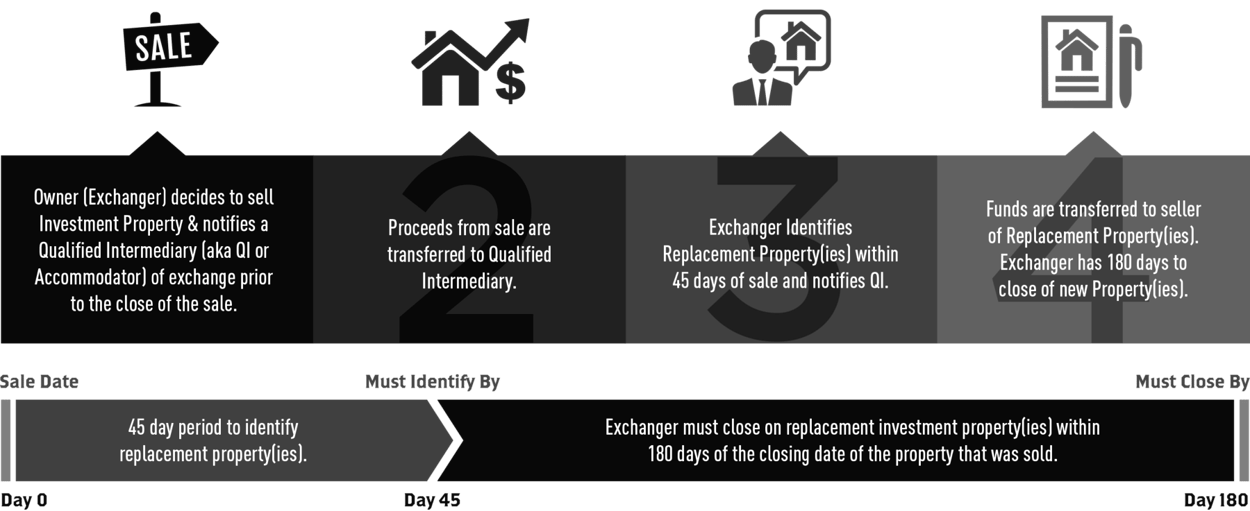

Though the basic concept of TIF is straightforwardto allow local governments to finance development projects with the revenue generated by the developmentits implementation can differ in each state and city where it. Tax abatements are the most frequent scenarios where the term is employed and they. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would.

For example the Portland Housing Bureau says its tax abatement program could save property owners about 175 a monthor about 2100 a yearfor a. Examples of an abatement include a tax decrease a reduction in penalties or a rebate. The storm suddenly abated.

A reduction of taxes for a certain period or in exchange for conducting a certain task. Abatement is a reduction in the level of taxation faced by an individual or company. An abatement reduces the taxes directly for a specific period of time.

Depending on abatement structure used property might actually not be subject to property tax if property isnt taxable then some doors open 100 abatement or payments in lieu of taxes pilot payments contractual pilot payments are outside normal property tax rules. The primary purpose for this new requirement is to provide. Tax-abatement as a means A temporary suspension of property taxation generally for a spe-cific period of time.

In certain situations they will even go as far as to revoke the extra charges altogether. Most owners of houses will be required to pay property taxes that are commonly from 1 to 3 of the value of the house every year. Penalty abatement removal is available for certain penalties under certain circumstances.

Governments use abatements as an. The difference is fairly simple. The most common types of penalty abatement are due to reasonable cause or first-time penalty abatement.

For example John Doe owns a house and owes 4000 in property taxes for the year. See More Nearby Entries. If an individual or.

A penalty or tax abatement can be defined as forgiveness of the penalties associated with tax debt that have been added on by the IRS over the course of the debt. All Tax Abatement Agreements shall require the recipient to construct or cause construction of specific improvements on the real property that is subject to the Abatement. Property taxes are a common subject of abatement though the term is often used when discussing overdue debt.

A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement. Abatement of Debts and Legacies is a common law doctrine. The meaning of TAX ABATEMENT is an amount by which a tax is reduced.

The difference between a tax abatement and a tax assessment. The term abatement refers to a situation where an economic burden is reduced. The policy was a clear departure from his campaign pledge which included the promise to allocate abatement revenue to a dedicated non-discretionary account for education funding.

Mayor Fulop signed his abatement policy into effect by executive order on December 24 2013. The verb to abate means to become less intense as in. You can request reasonable cause penalty abatement by writing the IRS.

Such arrangements are known as tax abatements.

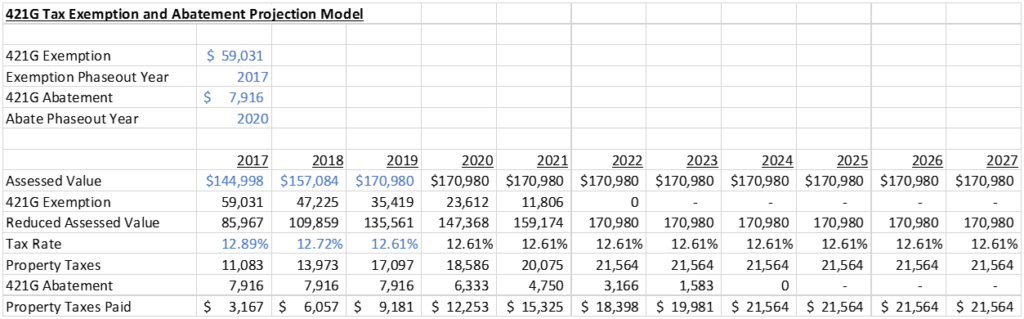

What Is The 421g Tax Abatement In Nyc Hauseit

Modeling Property Tax Abatements In Real Estate Youtube

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc Real Estate Taxes 421a Tax Abatements And Manhattan Property Tax

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Top Rated Tax Resolution Firm Tax Help Polston Tax

Reduce The Taxes You Owe When You Buy A Home Front Door

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

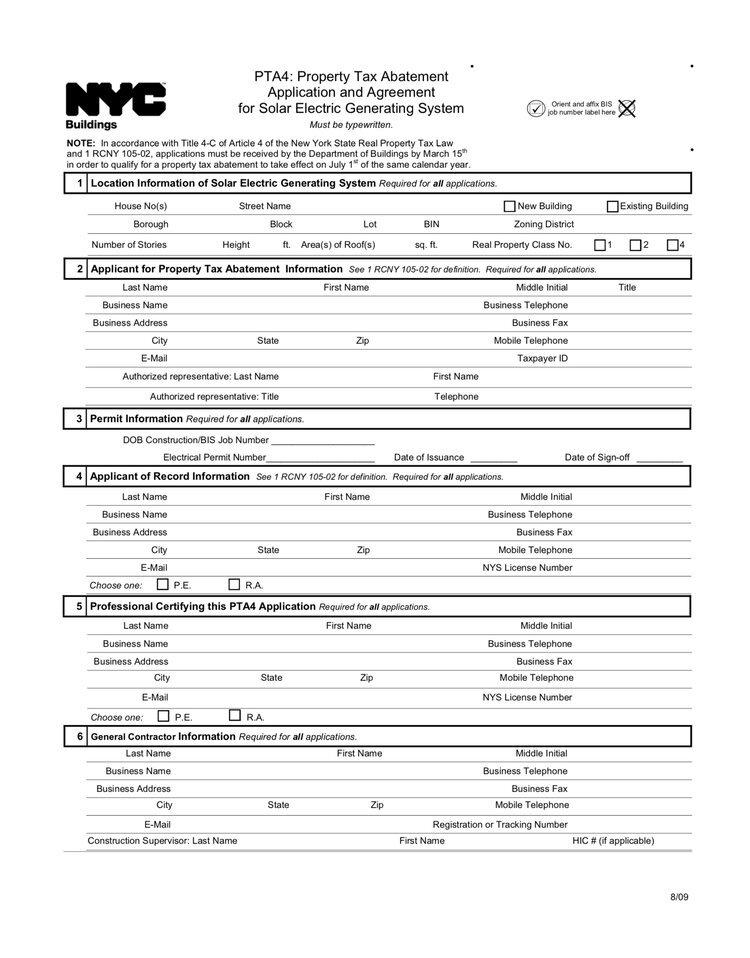

Nyc Solar Property Tax Abatement Pta4 Explained 2022

West Midtown S Interlock Project Could Claim Another 5 4m In Tax Abatement Eco Architecture Urban Design Concept Urban Concept

What Is The 421g Tax Abatement In Nyc Hauseit

Germany S Vehicle Tax System Small Steps Towards Future Proof Incentives For Low Emission Vehicles International Council On Clean Transportation

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit